Coronavirus Is Starting to Slow the Solar Energy Revolution

The coronavirus outbreak is threatening to slow the global solar-energy revolution as it cuts the supply of key equipment for solar and wind farms in China and beyond.As cases of the disease mounted over the past week, manufacturers including Trina Solar Ltd. sounded the alarm over production delays while developers like Manila Electric Co. in the Philippines said projects would be held up.“If the virus outbreak lasts beyond the first quarter and spreads to more geographies, as is currently happening in Korea and Italy, then it may very well slow down global renewable energy deployment,” said Ali Izadi-Najafabadi, head of analysis in Asia for BloombergNEF which has downgraded its outlook for installations this year.

While China is slowly starting to get back to work after an extended shutdown to contain the virus’ spread, many factories are still not at full capacity amid a lack of staff and raw materials. Green manufacturers are not spared, with analysts and industry groups flagging the potential for higher costs and a hit to overseas operations, especially if the outbreak continues.

For now, the impact on green companies remains manageable and mainly confined to areas in China where the coronavirus was first found. Solar giant LONGi Green Energy Technology Co. has said it sees no significant impact on its panel sales and production as it kept shipment targets for the year unchanged.

Even so, the warnings that have started to trickle out are a reminder of China’s importance in the global supply chains involved in building clean-energy plants and reducing the pollution that’s damaging the climate.

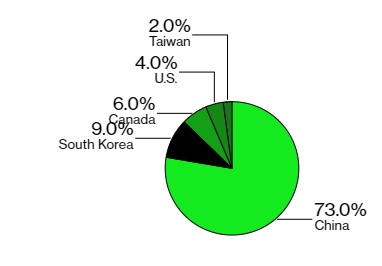

The country leads the world both in installing new wind and solar farms and in producing photovoltaic panels used almost everywhere. Of the top 10 cell makers, nine are mainly Chinese manufacturers and one is from South Korea.

Solar Giant

China is the world’s largest solar module producer

Source: BloombergNEF

Note: Figures are from 2018

Source : Bloomberg